CBDC by RBI for financial access

Table of Figures

Fig 1: Taxonomy of Money

Fig 2: A snapshot of the public data bank directory of WGI

Fig 3: Economy-wide Access Implementation

Fig 4: An illustration of the proposed CBDC transaction flow

Fig 5: An illustration of Flow for Farm Loan

Fig 6: An illustration of Flow for International Remittances

Fig 7: An illustration of a Process Flow for Social Development Organisations(e.g. NGOs) and communities raising funds for a community crisis

Introduction

In recent years, India has experienced significant growth in the digitization of its economy. This growth can be attributed to faster policy reforms and technological advancements. Factors such as demonetization exercises, affordable data plans, increased smartphone usage, and services like UPI and e-RUPI have transformed the payment ecosystem.

However, this progress has primarily benefited users in Tier 1 cities, leaving behind a large population of "Bharatvasis." While demographic factors play a role in determining digital payment adoption, there is evidence that people's perception of these instruments and their trust in the overall payment framework influence their usage.

Fortunately, signs indicate that Bharatvasis are ready to embrace digital payments if simple and user-friendly products are made available in the market.

The Reserve Bank of India (RBI) can leverage this opportunity by launching the Central Bank Digital Currency (CBDC). By doing so, India's payment ecosystem can offer consumers various digital payment options that promote financial inclusivity and increase digital transactions.

The COVID-19 pandemic prompted central banks worldwide to implement unprecedented fiscal and monetary stimulus measures. At a national level, using CBDC would enable RBI to directly stimulate Bharatvasis through fiscal subsidy transfers - often called "helicopter money."

CBDC also holds the potential to facilitate low-cost domestic and cross-border remittances for migrant workers. It can make payments faster, more secure, and cheaper.

Moreover, CBDC could support various use cases such as multi-signature transactions, self-custody arrangements, escrow services, and efficiently managing resources.

To ensure interoperability with different distributed ledgers across protocols while reducing risk for counterparties offering services on any protocol basis, existing protocols can be adapted for CBDC implementation.

Implementing CBDC would affect the central bank's monetary policy strategy and operating procedures. It could potentially increase productivity among lower-income households and small businesses. Additionally,

CBDC could be designed as interest-bearing assets directly tracked by Central Banks, allowing for more flexibility in adjusting interest rates during economic shocks.

Lastly, CBDC eliminates the need for an inflation buffer, commonly known as "helicopter money."

This knowledge base provides insights into the challenges and offers technology-based recommendations for RBI to launch a CBDC using open-source best practices.

http://Migrationpolicy.org . n.d. “The Rise in Remittances to India: A Closer Look.”

https://www.migrationpolicy.org/article/rise-remittances-india-closer-look

UPI: Unified Payments Interface (UPI) is an instant payment system introduced by GOI to facilitate transfer of money between bank accounts.

https://www.npci.org.in/what-we-do/upi/product-overview

E-rupi : e-RUPI is a one time contactless, cashless voucher-based mode of payment that helps users redeem the voucher without a card, digital payments app, or internet banking access.

https://www.npci.org.in/what-we-do/e-rupi/product-overview

RBI Bulletin December 2018

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/02AR_111220180F73AB0873744414AD564BAE69A28A43.PDF

Latest Meeting Minutes of the MPC, RBI: Reserve Bank of India which.i.e. Central bank of India

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=53601

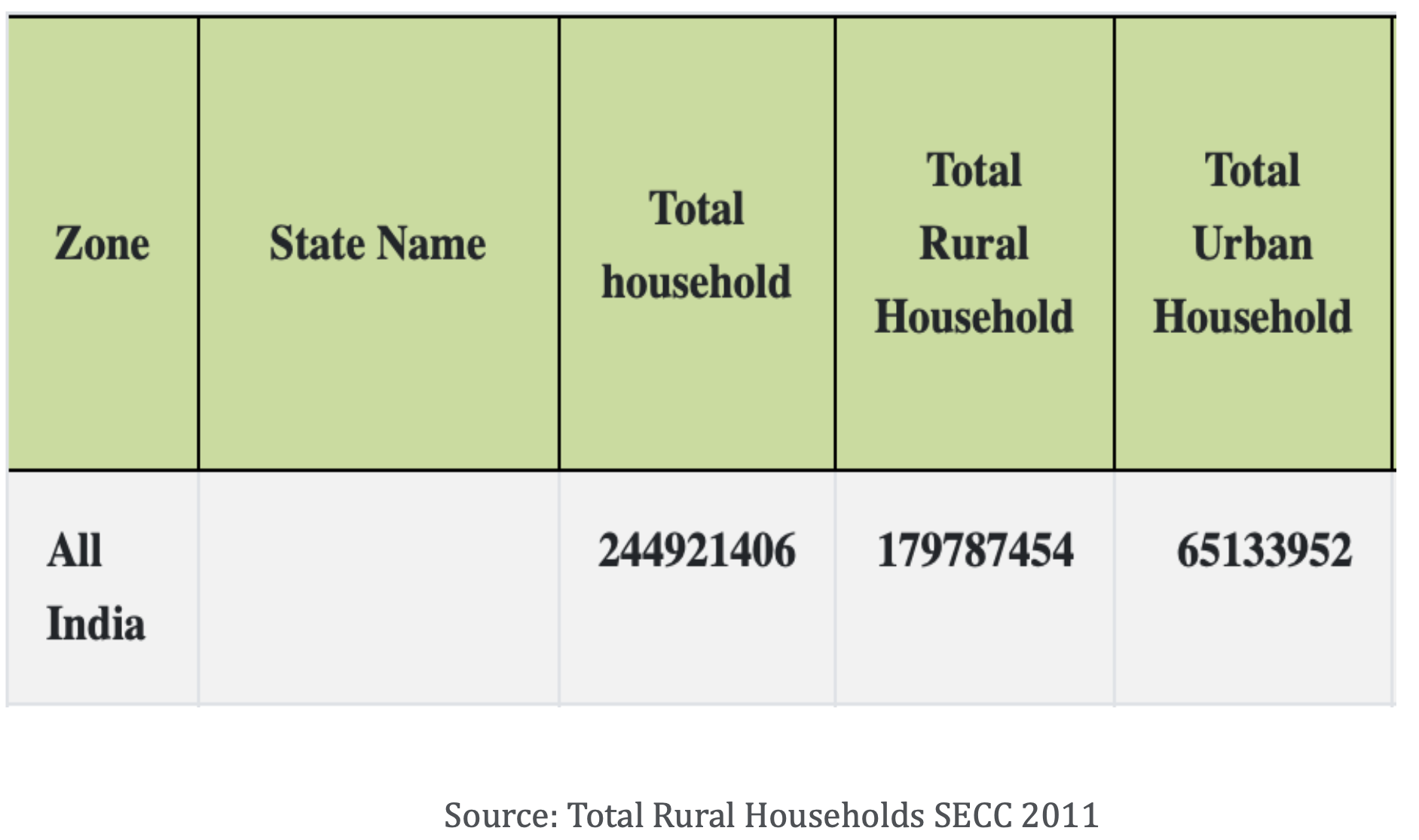

Principal Population Demographics

Availing banking services (total households) (%) 59%

Availing banking services (urban households) (%) 68%

Availing banking services (rural households) (%) 54%

Rural deposit accounts of scheduled commercial banks (RBI) 667,461

1. Insights

Fundamentally, the government-backed currency is fiat currency, which maintains the unit of accounting, a method for storing value and a medium of exchange. The efficacy of the currency depends on recognising the public authority power vested in the government. Most governments today are exploring multiple ways of creating a digital representation, which is CBDC, i.e., a legal tender issued by a Central Bank in a digital form. Its usage is the same as that of a fiat currency, only its form is different.

Digital Money

‘Cryptography’ was derived from the term “cryptos”, which means hidden. It is the study of secure communications techniques that allow only the sender and the message’s intended recipient to view its contents.

A large-scale and military-grade security case study of cryptographic communications was already seen during the 20th century World War II, when Alan Turing broke the Enigma code, with Turing's work at Bletchley helping counter German attacks at the same time, putting an end to the war. Since then, cryptography and cryptic communications systems have come a long way, with the banking industry and governments worldwide adopting promising use cases of cryptography in executing communications, underlying an exchange of value.

Digital Money is based on either of the two frameworks:

a. Tokenization of Stored Value or

b. Stored Value in Accounts.

Here, “Tokenization” is a process where some forms of assets are converted into a token, which has an intrinsic “value”. This “value” can be moved, stored, or recorded in the system.

Contrary to this, balances in reserve accounts and most forms of commercial bank money are account-based. A system based on account money depends fundamentally on the system’s ability to verify the account holder’s identity.

This concept of cryptographic encryption severely enhances the security of the digital information exchange(in a monetary transaction) between two parties over a public network. The argument is not only based on the decentralised and distributed nature of the cryptic communications (for any transactions that bear the signatures of digital money) but also upon factors such as the computing power of the network and the governance structure of the network, besides the audit footprint that such a payment network leaves, when it executes a transaction between two parties.

Distributed Ledger Technology

DLT Includes a set of concepts related to the use of Distributed Ledgers, a type of database characterized by not being managed by a central administrator but by a variable number of parties that use a consensus method to decide what information will be recorded on the database ledger.

DLT uses cryptographic schemes to ensure the immutability of registered information. Blockchain is a particular DLT category where information is stored in blocks and connected by hashes.

Medium of Exchange (a convertible asset)

Any asset widely accepted in exchange for goods and services carries a unique denomination, has a unique standard of value, and is available in several forms.

Ecosystem

Organizational networks which work together in synchronization to stimulate the economy, enhance user experience & promote social financial inclusion.

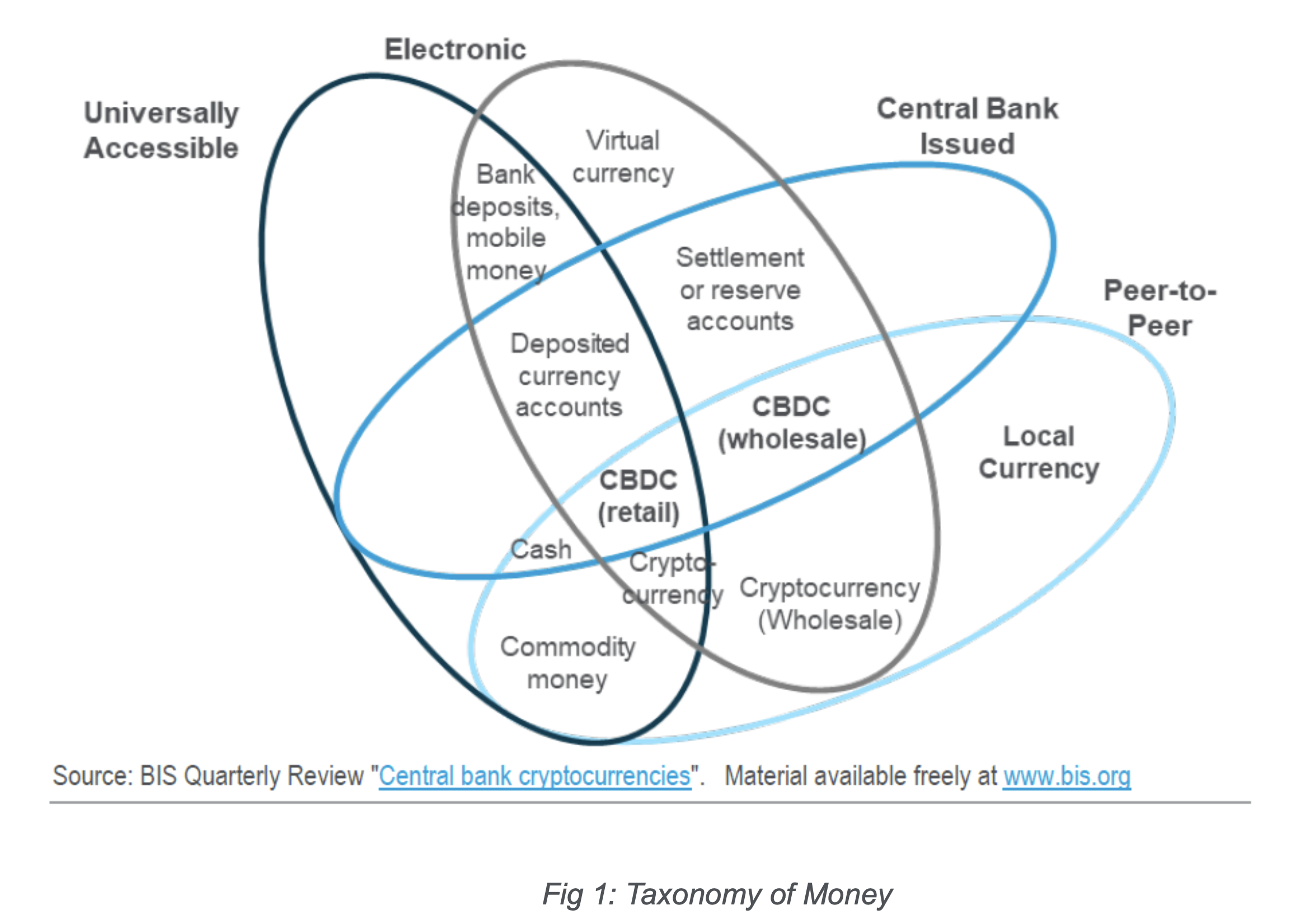

The below diagram represents the ‘Taxonomy of Money’ of CBDC:

2. The Design Principles

The CBDC is an electronic representation of the Indian Rupee (Fiat Currency), whose value is convertible on demand by the bearer, based on a cryptographic consensus protocol regulated by RBI.

A Central Bank digital currency (CBDC) is a Central Bank liability, which is digitally created and recorded on centralized or decentralized ledgers, denominated in an existing unit of account, and convertible in physical cash, commercial bank money and other forms of money on demand, by the holder at authorized entities.

“A CBDC will accelerate Bharat’s digital intimacy and bring millions of Bharatvasis into the financial mainstream.”

Firstly, the RBI may give everyone an account, just as banks offer bank accounts. Access to these accounts could be direct or intermediated by third parties, which could hold customer CBDC in trust and take care of Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) screening requirements.

The second candidate type is for the CBDC to take the form of a digital token that can be held, transferred and managed via an anonymous wallet like cash today.

Privacy is a well-known issue when it comes to government collection of data with surveillance on its citizens, and these risks are even higher for marginalized communities.

At the same time, a CBDC should not protect illegal transactions and tax evasion (Grothoff, 2021).

RBI must take a hybrid approach and allow tokenized wallets to be identified in case of distribution of programmable CBDC for subsidies or remain anonymous wallets for privacy.

Furthermore, RBI can impose limits on anonymous wallets to ensure legal compliance with AML and combat the financing of terrorism (CFT) regimes.

2.1 Lifecycle Management

Maintain Regulatory Oversight over the Network’s Lifecycle

The CBDC should have flexible and programmatic controls to ensure it is not easily tampered with by geo-political influence and bad state actors. See Worldwide Governance Indicators below for India.

Fig 2: A snapshot of the public data bank directory of WGI

The regulatory controls can be designed into CBDC implementation through:

A public governance system (voting-based) where consensus by the general public is therefore incorporated within the CBDC framework

Lifecycle management by an authorized and autonomous public authority, constituted by RBI with specific performance criteria, in alignment with the RVC’s monetary policy.

Chapter IIIF: Constitution of Monetary Policy Committee, Reserve Bank of India Act, 1934 and subsequent amendments

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/RBIA1934170510.PDF

https://rbidocs.rbi.org.in/rdocs/content/pdfs/MPCR2016_03112021.pdf

RBI should use existing human capital and infrastructure of autonomous institutes such as NPCI and similar existing initiatives by RBI, which may not only accelerate the CBDC implementation but also steadfastly support the principal, autonomous body(maintaining the CBDC network)

Source: Worldwide Governance Indicators.

Government Effectiveness Indicators capture perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government's commitment to such policies. Estimate gives the economy's score on the aggregate indicator, in units of a standard normal distribution, i.e. ranging from approximately -2.5 to 2.5.

Kaufmann, Daniel, Aart Kraay and Massimo Mastruzzi (2010). "The Worldwide Governance Indicators: Methodology and Analytical Issues". World Bank Policy Research Working Paper No. 5430 (http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1682130 ).The WGI does not reflect the official views of the Natural Resource Governance Institute, the Brookings Institution, the World Bank, its Executive Directors, or the countries they represent.

RBI should consider that public consensus becomes a crucial cog in the wheel for the broader adoption of digital currency. This also allows more stakeholders, including the BFSI(banking, financial services and insurance) industry, to participate in the CBDC framework.

RBI must consider maintaining a rigorous open source & public consensus mechanism, which is critical to enhancing RBI’s transparency standards for a regional value chain(RVC) of over 1.38 billion. Institutionalizing the responsibility of maintaining an open consensus framework may rest with a body incorporated along the lines of (b)(c) above.

CBDC is meant to benefit the Bharatvasis, broader goals of social and financial inclusion and the RVC's global commitment to sustainable development goals.

Volatility Protection Mechanism

A stablecoin such as CBDC pegged to fiat currency can be exposed to volatility, and even 0.0001% fluctuation can be disruptive to monetary policy. For example, during a catastrophic or Black Swan event, the public may overpay to avoid losses and move into stable currency or other ways when attempting investment opportunities.

CBDC must be frozen to a real-time value of the INR, making it impossible to transact unless the received face value is an equal amount.

Governance Layer:

A governance layer of the CBDC implementation shall allow for RBI to supervise regulatory controls, e.g. whitelist/blacklist/suspend wallets, and to act and seize funds in a wallet, e.g., in case of non-compliance to AML or via a court order.

The governance layer allows RBI to recover lost funds by moving the funds from any wallet into any different wallet or for legal holders to move money from the old wallet to a new wallet. To prevent financial abuse, RBI may limit payments to whitelisted wallets and authorized providers, e.g., RBI can maintain an Acceptable Usage Policy where certain legal bodies are blacklisted amongst dark web providers. CBDC is never allowed to be utilized or traded by the blacklisted legal bodies.

Identity Layer:

The implementation must allow RBI to choose if specific holders (but not all) require KYC before the funds move in or out of the wallet.

The existing Direct Bank Transfer (DBT) program can be moved to CBDC tied to a smart contract, e.g., the money can only be spent on farm equipment. For such wallets, the KYC can be made mandatory, and the information can be held under the jurisdiction and control of the RBI, but on the network, the holder remains anonymous. The Identity layer can also allow RBI to set a time (once a year) when the holder must repeat biometric verification of NPPIs to avoid their funds being locked in their wallets.

This layer also allows RBI to regulate the waiver of KYC requirements for wallets, holding CBDC funds below a threshold.

We observe that RBI should place non-tamperable and programmable fund limits on the amount of CBDC that can be held in non-KYC wallets and automatically freeze the transactions or wallets above this threshold, requiring KYC before allowing the transactions to proceed.

Fund limits can be similar to most of the retail transaction authorization policies mandated by RBI and applied to the usage of debit/credit cards.

2.2 Taxation Protocols

RBI can apply from time to time different taxation protocols on the CBDC payment network following the economy’s taxation policy.

An implementation may include auto-debit of tax amounts by applying deduction policies directly on the wallets or the ability to appropriate tax liabilities on behalf of citizens, especially in the case of enforcement of a public authority order such as those of the Tax Department’s tribunals and Indian judiciary.

CBDC can potentially reform the GST credits and deductible system of the economy’s largely unorganised MSME ecosystem. The network’s interoperability with the globally relevant VAT reporting systems is also paramount for RBI’s.

When used for foreign inward and outward remittances, CBDC implementation has the potential to provide scalable grounds for dynamic and modular enforcement of taxes associated with cross-border digital services and e-commerce activities.

RBI Press Release on India’s Inward Remittances Survey 2016-17, dated Aug 19, 2018

https://www.rbi.org.in/scripts/FS_PressRelease.aspx?prid=44722&fn=5

We believe that with a safer and scalable adoption of the CBDC payment framework, RBI stands to position itself as a reform body, assisting in a progressive taxation policy implementation.

We recommend a step-wise implementation of taxation policies on the CBDC framework.

The literature on the economy’s income tax and RVC, GVC-linked taxes have undergone several amendments over the last few years, especially in light of the recent GST implementation and the ability of traders to comply with GST norms.

Naturally, the taxation protocols should be first implemented on wallets held by legal bodies(companies, MSMEs, proprietorships). Wallets owned by farming and agri-businesses should be exempt from the taxation protocols in the wake of the global and regional food security crisis. The Indian economy has seen changes and reforms in agricultural laws and social development. Exempting these sector’s retail wallets from taxation protocols, for now, would allow lawmakers sufficient room to reform taxation laws in these sectors to standardize taxation protocols and organise the sector well.

In the second stage, taxation protocols should be implemented on wallets held by natural persons and individual taxpayers. Read Public Data on Payroll Reporting of Employed Individuals.

Ministry of Statistics & Programme Implementation

Payroll Reporting in India, An Employment Perspective, Feb 2022

Our observations on the second stage are timed to a successful passage of an appropriate Data Privacy and Protection law. (also read Section 2.5)

In the third stage, Double Taxation Avoidance(DTAA) Treaties can also be brought under the ambit of the CBDC’s implementation.

Our observations on the third stage are timed to a global cooperation effort on CBDCs and each Central bank’s CBDC’s interaction on the foreign exchange networks.

2.3 Flexibility

Dynamic Regulatory Controls

The governance layer protocol should allow RBI to control the CBDC even after the currency is distributed to the Bharatvasis. There must not be a need to recall or reissue a new digital currency to extend its functionality or to execute a new monetary policy.

Encourage Commerce

RBI should encourage Bharatvasis to use CBDC to support economic growth or achieve other financial inclusion goals. RBI should be able to set automatic rules in the governance layer. The rules can trigger tax credits or deposits for direct subsidy programs.

Mint and Burn

RBI must have the ability to mint and burn CBDC in line with monetary policy that is tied to programmatic events. For example, mint new CBDC tied to the official consumer price index or burning when bonds/loans are paid back.

Settlement Alternative

The CBDC does not need a settlement system. The transactions occur on a smart contract using the exact amount; any amount above the counterparty must be returned to whichever side it belongs to.

2.4 Carbon Footprint

The CBDC should run on a network of computing machines which register the lowest end of carbon footprint by the monetary exchange system. The offsets produced can strengthen India’s commitment towards COP26 conventions.

For the CBDC implementation, RBI should introduce capacity-building measures and research frameworks to be able to quantify the carbon footprint from the CBDC payment infrastructure accurately.

2.5 Data Privacy

The CBDC framework has the potential to disrupt India’s commercial activities. At the same time, the CBDC network can also produce, process and maintain, in its control, tremendous amounts of consumer data.

Without solid data privacy and protection policies designed explicitly for the CBDC framework and stipulated in Privacy Protection Laws, it is our most vital suggestion not to launch CBDC.

In the absence of the most robust data privacy laws, there is a specific threat of the collapse of the monetary system, and bad actors may take advantage of the data security loopholes.With a robust data privacy and protection regime designed explicitly for CBDC, its expansion into the foreign exchange systems and global monetary policies is optimistic and widespread.

It is our most robust observation that RBI emissaries work on global cooperation with Central Banks of other economic regions, such as the EU, and their efforts on CBDCs.

The Implementation Framework

Electronic Central Bank money is not a new concept. It has existed for decades as reserves held by Commercial Banks and other selected financial institutions at the Central Bank to facilitate electronic settlement in Real Time Gross Settlement (RTGS) systems.

We define CBDC as electronic Central Bank money that:

Can be accessed more broadly than reserves,

Potentially has much greater functionality for retail transactions than cash,

Has a separate operational structure from other forms of Central Bank money and

Can be interest bearing

This knowledge base focuses on a system where direct access to CBDC is extended to households and non-financial organisations, thereby covering the economy. This model can be referred to as the Economy-wide Access Model.

In this model, alongside banks and NBFCs, households and organisations will also have access to CBDC.

CBDC can, therefore, serve as money for all agents and stakeholders in the RVC’s economy. Access does not imply that the Central Bank provides retail services to all holders of CBDC.

Households and organisations must use a CBDC Exchange to buy/sell CBDC in exchange for deposits, while banks and NBFCs can interact directly with the Central Bank to buy/sell CBDC.

There must also be an open avenue wherein households and organisations can directly trade CBDC with the Central Bank to be feasible and trade amongst households and organisations.

It is our observation that a CBDC Exchange should be a new standalone entity or one which is operated by a bank or NBFC but with a special regulatory license. A unique regulatory license requires existing banks and NBFCs to increase their technology capacities to comply with the exchange licenses.

Fig 3: Economy-wide Access Implementation

The above figure illustrates the interaction between the Central Bank, Commercial banks, NBFCs, a CBDC Exchange and the households and organisations.

Under the proposed model, all banks, NBFCs, CBDC Exchanges households and organisations can have a CBDC account at the Central Bank. Only banks, NBFCs and CBDC Exchanges can trade CBDC directly with the Central Bank. Households and organisations can instead use a CBDC Exchange to convert deposits to CBDC and vice versa. A CBDC Exchange may be a new standalone entity or operated by an NBFC or bank. In our diagram, we have separated the operation of CBDC Exchanges rather than consolidating them into balance sheets of banks or NBFCs.

Assuming that banks and NBFCs do not themselves use the services of CBDC Exchanges given their direct access to the Central Bank and their ability to transact in the wholesale debt markets to acquire eligible collateral. CBDC account holders can trade CBDC among themselves in exchange for assets or goods and services. Banks, in addition to having CBDC accounts, also have access to reserve accounts at the Central Bank. CBDC Exchanges will have access to reserves, and no bank or NBFCs use their access to Central Bank money to provide an asset to households and organisations fully backed by Central Bank money.

Banks maintain debit and credit positions with NBFCs, households, and organisations. NBFCs provide financial services to households and organisations, including fund management services, which result in NBFCs having a financial liability to the household and firm sector. Since households and organisations cannot buy CBDC directly from the Central Bank, they obtain additional CBDC through a CBDC Exchange. In its simplest form, a CBDC Exchange takes bank deposits from households and organisations and provides CBDC in return and vice versa. It may charge a fee or spread for this service. It is also conceivable that banks may choose to absorb any cost to customers, as they do not pass on the cost of providing cash today. To replenish its holdings of CBDC, the CBDC Exchange uses the deposits it receives to purchase gilts, then uses the gilts to obtain CBDC at the Central Bank.

CBDC, as a replacement for cash, should ensure both –

Universal e-wallets that allow any user to send/receive digital currency. This provision allows the anonymous exchange of money, like “cash in hand”.

KYC e-wallets allow sovereign institutes to track programmed curren’s decision.

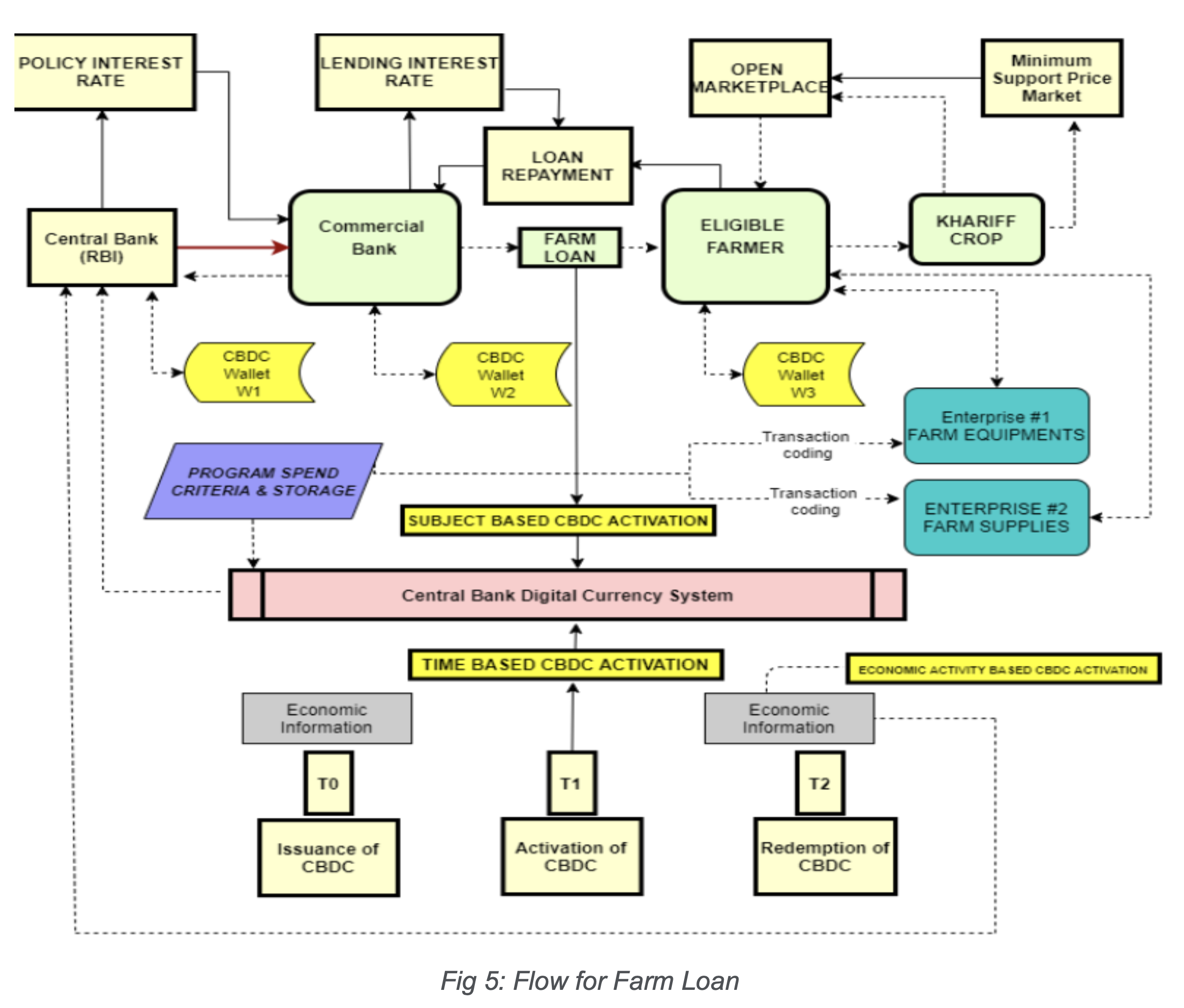

Loans can be offered to incentivize a particular crop using “negative rates” programmed within Digital Currency.

Crop Insurance can be done away with. Damage to production can be programmed for “non-return” within Digital Currency.

Pricing Controls can be programmed at multiple points using Smart Contracts.

Agriculture constitutes 20% of GDP as per Economic Data 2020-21.

NPAs for Farm Loans are approx—12% of total NPAs.

In 2019, total farm loan NPAs stood at 8,79,000 Crore.

The average Lending rate is 7%.

Subsidised and sustainable lending practices can be promoted using CBDC, including more robust implementation of anti-usury legislation. This has both direct and indirect positive effects on India's agricultural economy.

Fig 5: Flow for Farm Loan

T0, T1, T2 – Time-based interventions.

The Government can plan Interest Rate interventions based on Socioeconomic conditions.

Digital Money is programmed to be used at approved Enterprises and merchants.

Use Case 2: Design of Remittances (Including Cross Border)

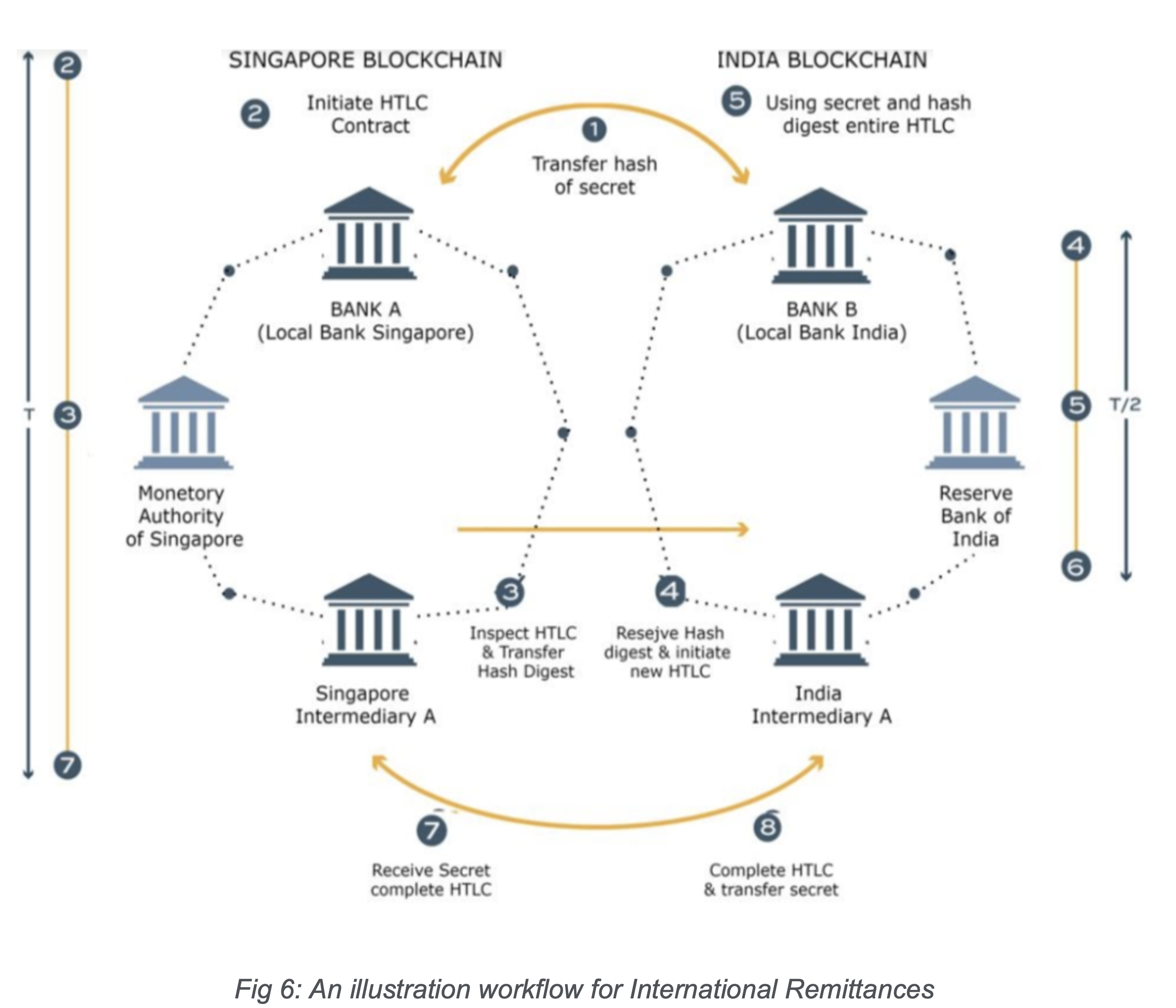

Near Real-Time Cross Border Payments by different remittance schemes of RBI, such as the Liberalised Remittance Scheme(LRS), and channels like the Money Transfer Service Scheme(MTSS) and Rupee Drawing Arrangement(RDA) besides the International Financial System (IFS) platform of Universal Post Union (UPU).

RBI circular on LRS https://rbi.org.in/Scripts/NotificationUser.aspx?Id=10192&Mode=0

Remittances [Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA)] January 18, 2017

No dependency on Swift-like systems or intermediaries.

High User Charges and fees are avoided.

Today, Fiat Money Transfer via Banks (Swift, etc.) can cost as much as 20% of the remittance amount.

Blockchain-based Issuance of Digital Currency has the potential to reduce this cost.

Blockchain Architecture may be a sovereign secret (private & permissioned network).

Blockchain Interoperability allows two Digital Currency Issuing Systems to interact via Hash Time-Locked Contracts.

Understanding Hash Time-Locked Contracts

An HTLC is a conditional transfer of value from “depositor” to “recipient” in which two distinct conditions prevent immediate execution.

The hash lock requires a proper “secret” to be presented to the blockchain before the time lock expiration; if this does not occur, the value automatically returns to the “depositor”.

This allows two parties to exchange assets on independent platforms without a trusted intermediary.

Fig 6: An illustration workflow for International Remittances

Use Case 3: Design of Social Goods and public benefits programs

Several prospects for CBDC use cases lie across regional and global cooperation between socio-economic organisations and development bodies, including those which are intertwined with both RVCs and GVCs.

In this conception, CBDCs with transparent and trustworthy open governance layers, and whereby economic unions and states alike have established policy priorities and provisions for fund allocation and appropriations of liquidity towards both regional or global crises.

An open-source Research and Development pilot case study, where the Muellners Foundation published a concept of “Liquidity to a crisis in motion”(LTCIM), is illustrated in the figure below.

Fig 7: An illustration of a Process Flow for Social Development Organisations(e.g. NGOs) and communities raising funds for a community crisis

Project Documentation: https://ltcim-docs.muellners.org,

Github-based Public repository of source code; https://github.com/muellners/ltcim ,

Application of LTCIM for Food Crisis during Covid pandemic in India, May 20221

Retail CBDC and the Role of the Commercial Banks

CBDC could be offered in two main categories, i.e.

Retail CBDC: low value, large volume and usually between individuals and businesses and

Wholesale CBDC: high value, low volume and usually between financial institutions.

There are three potential scenarios of retail CBDC. In each scenario, the CBDC is issued by the Central Bank but differs in terms of who is ultimately liable.

Scenario 1 Shares many parallels with the current retail payment process, as the set-up also includes an intermediary layer of financial institutions. These institutions are in charge of onboarding and communicating with individuals and businesses, sending payment messages to other financial institutions, and ultimately transmitting payment instructions to the Central Bank for settlement.

Scenario 2 involves individuals and businesses holding CBDC through private accounts at a Central Bank. Intermediaries are no longer necessary, as the Central Bank takes over the role of onboarding and handling all payment services. This scenario is likely to materially affect the structure of the current financial system and substantially increase the roles and responsibilities of Central Banks.

Scenario 3, which we have focussed on here in this knowledge base, is a combined version of the previous two scenarios. While there is an intermediary layer of financial institutions, individuals and businesses still have a direct claim of a CBDC at the Central Bank. A key implication of this scenario is that intermediaries could keep the CBDC segregated from their balance sheet and that individuals and businesses could benefit from increased portability.

Scenario 3 requires an open-source platform lifecycle approach to bring multiple independent and autonomous stakeholders together.

A retail CBDC could also drive the adoption of cashless transactions. If CBDC qualifies as a legal tender, it would provide a credible and trustworthy alternative to current cash transactions. Faster settlement is also a vital advantage of a CBDC-based payment system. Its direct links to Central Banks and the reduction of domestic and cross-border intermediaries could significantly improve the efficiency of retail payments. Ideally, these time and cost savings would then be passed onto individuals and businesses, who would benefit from lower transaction costs as a result. CBDC could improve the speed and efficiency of Central Bank currency circulation, increasing the proportion of M0 in the economic system and reducing leverage and systemic financial risks. The CBDC would require cooperation from existing Banks to perform their domestic operations as the current banking infrastructure has an excellent geographical reach. Also, to identify the reliable and compliant principles for CBDC. To achieve these objectives, the new Central Bank payment platform and CBDC must integrate state-of-the-art cybersecurity tools and monitor customer due diligence, potential money laundering operations and fraud.

The Role of Commercial Banks

Phase-wise implementation - Central Banks must work hand in hand with Commercial banks, ensuring cooperation to facilitate the CBDC research and development.

Two-tier banking model - commercial banks along with Central Banks would both lessen credit risk for Central Banks and relieve them of consumer-facing functions they’re simply not equipped to provide. Broad roles are listed below.

Continued commercial bank role: Distributing cash, processing payments electronically, safe holding of deposits, and capital lending. Screening, onboarding, offboarding, servicing, building and maintenance of technology platforms

Change in commercial bank’s role: Changes to traditional payment processing: While commercial banks can expect to continue payment processing, the task would be to understand and address how functionality will change, knowing that things like knowing your customer and anti-money laundering practices will still apply to CBDC.

Careful calibration and a nuanced approach in implementation with banks needing to adopt advanced technologies and apt tech team to support

Identification of reliable principles to encourage innovation.

Real-time and cost-effective globalization of payment systems.

The introduction of CBDC has excellent potential for benefits like

Reduced cash handling

Higher seigniorage due to lower transaction costs,

Reduced settlement risk.

Challenges of CBDC Implementation

Every system comes with its challenges. The case is no different for CBDC & its implementation, too. We have tried to put together some significant points which may qualify as the topmost challenges among the many in the upcoming journey of CBDC.

Threat to Privacy

Central Banks will have increased control over money issuance and more significant insights into how people spend their money, potentially depriving users of their privacy.

The Republic of India is a democratic governance system based on India's constitution.

Regulatory bodies, including RBI, should consider that solid data protection regulations are warranted before launching CBDC.

Strong data protection and privacy laws and exclusive data privacy laws that shadow the CBDC implementation in the banking system to ensure the monetary system of the middle-income economy does not collapse in the wake of:

Non-compliance of stakeholders to globally relevant data protection laws.

Noncompliance or breach of data protection in a natural disaster or a man-made emergency.

Non-compliance of breach of data protection in the event of AML and financial fraud indicators from within the banking industry.

Cyber Risks

Defending against cyber-attacks will be more difficult as the number of endpoints in a general-purpose CBDC system will be significantly larger than those of current banking systems. A robust risk-mitigating structure is a prerequisite for the Central Bank to issue a CBDC.

In national blockchain strategies, there should be an accelerated focus on building up an ecosystem of independent, nodal Audit platforms. These can be natural persons or legal bodies such as banking institutions, NBFCs, and Telecom service providers.

These Audit platforms act as nodal agents and execute contracts to release rewards directly from an RBI-mandated Escrow account whenever cyber security or a data protection breach is identified on the platform’s application layer.

Escrow should be funded by each participant(FI) fintech platform, which is on the Central Bank’s regulatory sandbox network.

Admission to the regulatory sandbox should not require minimal capital rather, the size of their network (which the participant maintains) itself should quantify what each participant will put into the Escrow for events of the breach.

Interoperability

CBDC can facilitate cross-border and cross-currency payments independent of work hours and holidays in different time zones. However, different legal and regulatory frameworks present a significant obstacle to cross-border payments. Harmonizing these frameworks is a global challenge.

A CBDC consensus protocol’s governance should, therefore, have characteristics of a global governance model.

Network Accessibility

CBDC would create the need for an end-user to always have access to internet connectivity. Events like Northern Grid (2012) can lead to interruptions in accessing the user's monetary funds implemented under CBDC.

CWC Note:

Contributors to this knowledge base have used below sources, references, public data banks and search engines to pinpoint the Financial Access indicators for the Principal Population Demographics for “Bharatvasis”: